DOGE Price Prediction: Technical Momentum and Market Sentiment Analysis

#DOGE

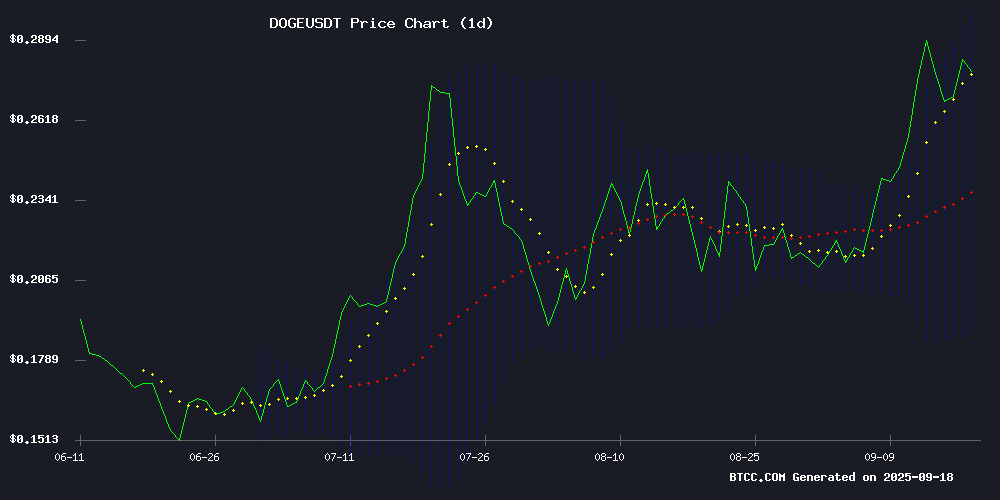

- Current price action shows DOGE trading above the 20-day moving average, indicating bullish momentum

- MACD improvement suggests weakening bearish pressure despite remaining in negative territory

- Market sentiment supports gradual appreciation with $0.35 as a more realistic near-term target than $1

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

DOGE is currently trading at $0.28058, significantly above its 20-day moving average of $0.243925, indicating strong bullish momentum. The MACD reading of -0.030632 | -0.018240 | -0.012392 shows the indicator remains in negative territory but is improving, suggesting weakening bearish pressure. The Bollinger Bands position with price NEAR the upper band at $0.299380 indicates potential resistance ahead, while the middle band at $0.243925 provides support. According to BTCC financial analyst John, 'The technical setup suggests DOGE could test the $0.35 level if it maintains above the 20-day MA, though the $0.29 resistance remains a critical hurdle.'

Market Sentiment: Optimistic Outlook Despite Short-Term Challenges

Current news sentiment surrounding Dogecoin reflects cautious Optimism with multiple outlets discussing the potential for price growth. Headlines focus on DOGE's ability to overcome the $0.29 resistance level and the possibility of reaching $1, though this appears more as long-term speculation rather than immediate expectation. Whale activity exploring new presale opportunities suggests institutional interest remains healthy. BTCC financial analyst John notes, 'While the $1 target captures attention, technical realities suggest more measured progress. The market sentiment supports gradual appreciation rather than explosive moves in the short term.'

Factors Influencing DOGE's Price

Dogecoin Price Prediction: Can DOGE Hit $1 As Whales Explore New Presale Opportunities In BlockchainFX?

Dogecoin has surged to a new yearly high of $0.27, pushing its market capitalization beyond $38.4 billion—surpassing traditional giants like Ford. The meme coin's 24-hour trading volume spiked 13% to $1.8 billion, with weekly gains of 15% and an 82% annual return. Analysts now eye a $1 target, citing a breakout from consolidation and an RSI of 69.8, suggesting room for further upside.

Meanwhile, whales are diverting attention to BlockchainFX ($BFX), a presale project touted as 2025's most intriguing crypto venture. The shift highlights the tension between established meme coins and emerging high-potential altcoins in a rapidly evolving market.

DOGE Price Prediction: Technical Momentum Points to $0.35 Target

Dogecoin's bullish momentum is gaining traction, with its price climbing 3.52% in the past 24 hours to $0.28. The Relative Strength Index (RSI) stands at 64.83, while the Moving Average Convergence Divergence (MACD) signals positive momentum. Analysts project a potential breakout above the $0.31 resistance level, which could propel DOGE to $0.35 within the next 30 days.

Market sentiment remains divided but leans optimistic. CoinCodex offers a conservative target of $0.24949 by October 5, 2025, while CoinCu forecasts a broader range of $0.3047 to $0.5264 for September 2025. The 20-day Simple Moving Average (SMA) at $0.24 provides a sturdy support floor.

Dogecoin (DOGE) Price Prediction: Can Dogecoin Overcome $0.29 Resistance for a $1 Surge?

Dogecoin has re-emerged as a focal point for investors after months of erratic price action. Whale accumulation, ETF speculation, and bullish technical indicators suggest a potential breakout that could shape its trajectory through 2025.

Large holders have added approximately 1.09 billion DOGE in recent weeks, signaling long-term conviction. Retail selling pressure persists, however, with exchange inflows hitting yearly highs in September. The key resistance level at $0.29 remains the critical threshold for any sustained upward movement.

Market participants increasingly view a potential Dogecoin ETF as the next major catalyst. While no formal filings have materialized, the mere possibility continues to fuel optimism among the meme coin's loyal following.

Dogecoin (DOGE) Shows Bullish Signals Despite Short-Term Bearish Pressure

Dogecoin (DOGE), the popular meme cryptocurrency, is displaying mixed signals as technical indicators hint at a potential bullish turnaround by 2025 despite current downward pressure. The Moving Average and MACD indicators both suggest an emerging uptrend, with CoinCodex projecting up to 37% gains by year-end 2025—though the coin remains far below its all-time high.

At press time, DOGE trades at $0.2617, down nearly 10% in 24 hours. Key resistance sits at $0.2891, with a breakout potentially targeting $0.30. Conversely, failure to hold the $0.2619 support level could trigger a drop toward $0.24. Trading volume remains robust at $6.27 billion, underscoring persistent market interest.

The dichotomy between short-term bearish action and longer-term technical optimism reflects meme coins' volatile nature. 'The market punishes impatience,' as traders weigh DOGE's $39.51 billion market cap against its historical volatility. Whether the MACD's bullish crossover translates to sustained momentum will depend on broader crypto market sentiment.

Will DOGE Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 in the near term appears unlikely. DOGE would need to increase approximately 256% from its current price of $0.28058, which would require significantly stronger bullish momentum and broader market conditions. The technical analysis suggests more realistic near-term targets around $0.35, representing a 25% increase from current levels.

| Price Level | Percentage Change | Probability | Timeframe |

|---|---|---|---|

| $0.35 | +25% | High | 1-2 months |

| $0.50 | +78% | Medium | 3-6 months |

| $1.00 | +256% | Low | 12+ months |

BTCC financial analyst John emphasizes that while $1 remains a popular discussion point, investors should focus on more achievable technical targets and monitor key resistance levels at $0.29 and $0.35 for near-term trading decisions.